Where Should I Stake my CRO?

Crypto.com Newbies – Crypto Visa Card, or Staking on the DeFi Wallet?

For many newcomers to the Crypto space, the Crypto.com app is an excellent starting point. Most crypto novices begin by downloading the app on their smartphones, and quickly realize the depth of its functionality. However, new users can easily become overwhelmed by the new vocabulary. Terms such as supercharger, staking rewards, and DeFi wallet, to name a few, can feel like an alternate language. In the following, we assume an initial investment of $4,000 in order to compare two popular wallet choices for storing and managing cryptocurrencies: 1) staking Crypto.com’s native CRO token on Crypto.org's DeFi wallet, or 2) subscribing to the Indigo Card.

Staking on Crypto.org's DeFi Wallet

Staking is the process of actively participating in transaction validation (similar to mining) on a proof-of-stake blockchain. On these blockchains, anyone holding even a fraction of a cryptocurrency token, or, if required, a minimum balance of a specific cryptocurrency, can validate transactions and earn so-called staking rewards. The security and operation of the blockchain network is supported. In most cases, cryptocurrency holders are required to use, e.g., a Trust Wallet to lock the cryptocurrency within a smart contract for a period of time. They may also use an exchange’s staking service to participate in staking.

The staking process is similar to holding a stock and receiving dividends. For cryptocurrency holders interested in holding for the long term, staking is always advantageous, because of the extra rewards earned as passive income. In contrast, cryptocurrency holders interested in trading may find that retaining the flexibility to sell at any time is more advantageous. This is because staked cryptocurrency must be locked up for a period of time, and can be released only by paying an early termination fee.

As of June 11, 2021, Crypto.com pays staking rewards of 14.75% APY for their native CRO tokens, minus a commission charged by the validators for their staking service. Note, however, that the CRO tokens are bonded. The unbonding period is 28 days, so the tokens cannot be sold for 28 days after unstaking. There are 100 eligible validators that can be used for the staking service; some feature 0% commission promotions. This means that delegators who stake their CROs with these validators actually earn the full 14.75% APY – see also our blog entry about what to look out for before staking your CRO with a validator https://www.siriusnodes.com/blog/how-to-choose-a-reliable-validator.

Next, we calculate the rewards. $4,000 must be exchanged for CRO tokens, ex. 40,000 (= $4,000 / $0.10 CRO price). Assuming the tokens are staked for an entire year at 14.75% APY, and that the price of the CRO token does not change, a staking reward of $590 (= 40,000 x 14.75% x $0.10) is realized.

Crypto Visa Cards

Before calculating the rewards on Crypto.com's Indigo Card, we provide a short introduction into the choice set of offered cards. Prepaid crypto visa cards represent a bridge between crypto portfolios and real-world assets, and will likely pave the way toward broader adoption. Among the wide selection of cards, Crypto.com's offering sits comfortably as the market leader. It is the most widely available crypto card, and features an unmatched set of perks. All cards are free initially. But, to unlock the increasingly favorable benefits, investors must take part in Crypto.com's platform by staking CRO tokens for 180 days. Those wishing to explore prepaid crypto cards should consider the Midnight Blue (Tier 1) or Ruby Steel (Tier 2) cards. However, investing with a Royal Indigo/Jade Green (Tier 3) card seems to be where things really get interesting.

Indigo Card

Crypto.com released its Consumer Spending Insights Report for 2020 to detail spending trends and data for its Visa card—the most widely available card of its kind in the world. This report constitutes the first look into spending trends for the Crypto.com Visa card. It finds that overall spending per user in 2020 grew 55% YoY, with a 117% increase in online spending. This illustrates the high popularity of the card.1,2

To obtain an Indigo card in the U.S., one needs to stake at least $4,000 in Crypto.com's CRO tokens, which equals about 40,000 CRO tokens (= $4,000 x $0.1, the assumed CRO token price). In this case, staking to be eligible for the Indigo card means that the CRO tokens are locked up for 180 days, and cannot be sold during this period. This may be detrimental to liquidity, if, for example, the holder needs or wants to sell the tokens sooner. After the 180-day lockup period, cardholders have several options: 1) They can reduce the staked amount and fall to a lower tier, 2) they can withdraw excess CRO, should the price have appreciated during the lockup period, 3), they can initiate a new 180 day lockup period, or 4) they can leave the CROs staked, but not locked.

Before we dive into the details, it is worth mentioning that the Indigo card is a prepaid credit card from Visa, and can be thought of as a debit card. Thus, there must be a sufficient balance on the card to process transactions. Crypto.com offers several options to refill the cards, for example, using Fiat currency (e.g., USD or CAD) with the Fiat wallet, funded by bank account transfers, using other credit/debit cards, or using cryptocurrency (e.g., converting holdings in CRO, BTC, etc., into local currency held on the card). In addition to 3% cash back, members of the Indigo card enjoy such benefits as 1) a reimbursed Netflix subscription ($13.99 USD); 2) a reimbursed Spotify subscription ($12.99 USD); 3) airport lounge access; 4) bonus interest in "Earn" on the Crypto.com app (+2%); and 5) a 10% staking reward on the locked CRO. Obviously, the benefits of the card scales with individual spending habits, however it is a “no brainer” to pass as many expenses on the card to convert expenses to investment.

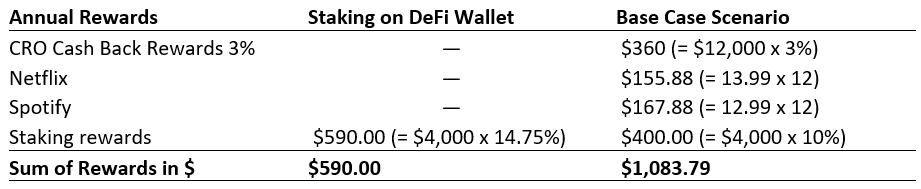

In a simple base case scenario, we assume that the CRO token price of $0.10 remains constant over the one-year period, and the user makes purchases of $12,000 with the Indigo card. There are additional benefits available, such as doubled discounts on gift cards, and earning bonus interest (+2%) for staking select crypto assets in Earn. All of these benefits make the Indigo card even more attractive, however for the sake of simplicity, we do not assign any value to those here. In sum, average users with $1,000 monthly expenses can expect, in the Base Case Scenario, to achieve a reward of roughly $1,083.

Conclusion

Comparing the choice between staking CRO tokens for 14.75% or subscribing to the Indigo card shows clearly that the Indigo card is the superior choice (see the table below for an overview). However, we must consider that, in order to obtain an Indigo card, CRO tokens are locked up for 180 days; for the staking alternative, the lockup period is only 28 days. This increased lockup period of about five months comes with substantial liquidity risk, especially when considering the recent high price fluctuations of CRO tokens, ranging from about $0.08 to $0.20.

To conclude, the more the users of the Indigo card take advantage of the available benefits, the lower will be their financial risk. This is because rewards are paid out in “hard dollars,” or in CRO tokens, which can be sold for Fiat. Nevertheless, the high volatility of CRO tokens, combined with the longer lockup period, poses a substantial liquidity risk. This means, for example, that CRO tokens could not be sold if the CRO appreciated substantially, nor could a limit order be placed to protect against sharp price declines. If the CRO token volatility and lockup period are too great of a concern, staking on the DeFi wallet may be a better choice. This is especially true when one does not plan to take sufficient advantage of the benefits that come with the Indigo card.

For anyone on the fence about the two alternatives, the Ruby card could also be an interesting alternative. It requires a lower staking amount of $400, but comes with fewer benefits and only 2% cash back instead of 3%.

(1) See https://crypto.com/research/article?category=macro&page=Consumer_spending_insights_2020.

(2) See https://fortune.com/2021/03/29/visa-crypto-business/.

Disclaimer

Don't invest more than you can afford to lose, and do your own research (DYOR) – this is not financial advice!

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. This information is general in nature and has not taken into account your personal financial position or objectives. Before proceeding please refer to a licensed adviser or tax agent and relevant PDS for product details before proceeding. It is very important to do you own analysis before making any investment based on your own circumstances (DYOR).

Sirius Nodes is not a registered investment, attorney, accountant, legal or tax advisor or broker / dealer. All investment / financial opinions are expressed by Sirius Nodes are from a personal research experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Past performance is not a guarantee of future return, nor is it necessarily indicative of future performance. Keep in mind investing involves risks. The value of your investment will fluctuate over time and your may gain or lose money.